makeup market, Buglisi Weiler replied, “a different option.

#Ulta mac foundation mac

When asked if Little MAC was conceived as an answer to the competitive onslaught of often lower-price startup brands, like the L’Oréal-owned NYX, in the booming U.S. MAC will be entering Ulta with 12 of these sku’s, three skin-care items and nine lipsticks.

#Ulta mac foundation skin

Little MAC mascara and skin care are priced at $12. The same price applies to pigments and lipgloss. The abbreviated lipstick is priced $10, instead of $17 for the full-size version.

#Ulta mac foundation trial

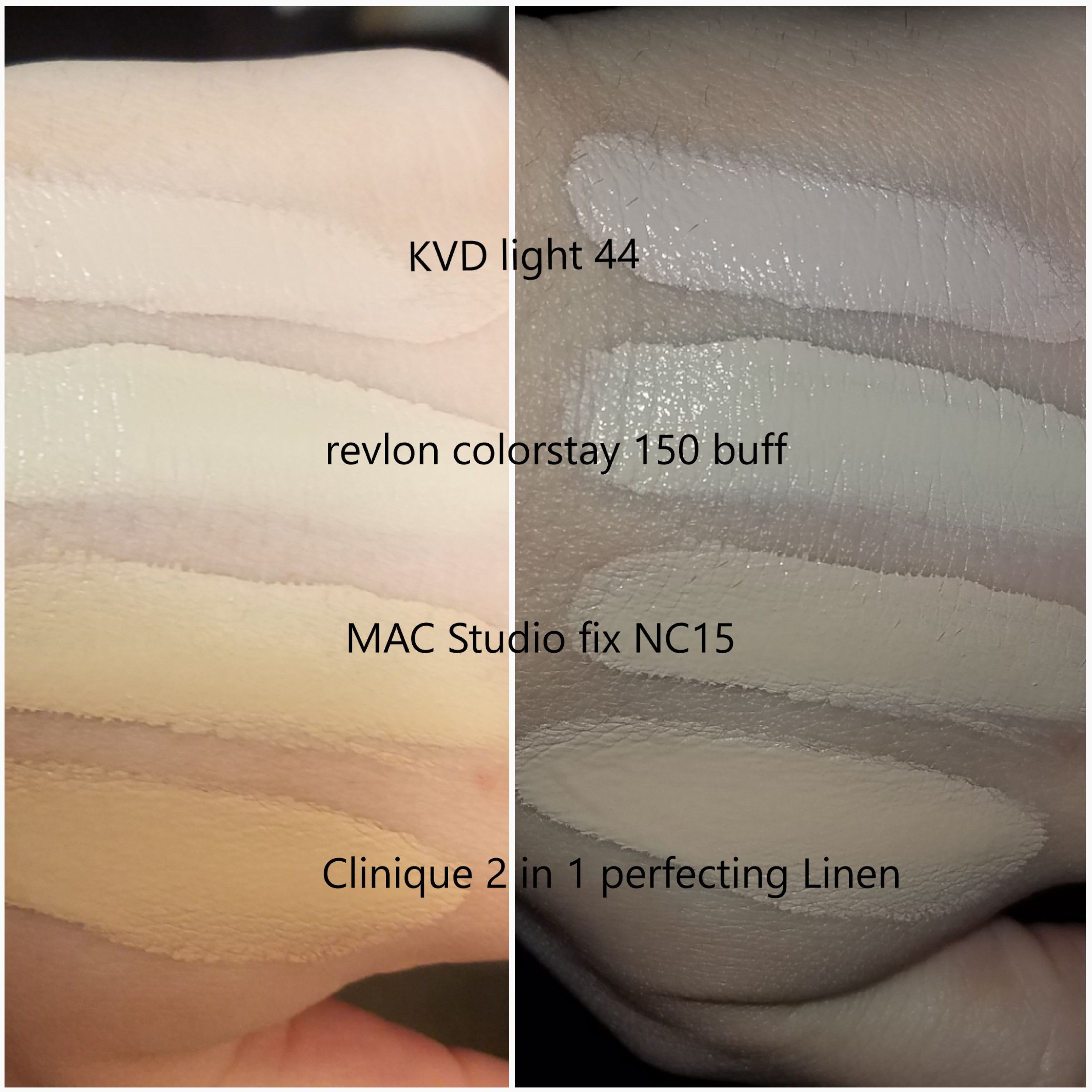

The brand has been experimenting with a Little MAC assortment, consisting of trial or travel-sized product. The brand also is working on its price points, perhaps with an eye toward maintaining its number-one sales ranking in the U.S. Retromatte, a liquid product, rounds out the lip assortment.īut the Ulta move isn’t the only more-populist shift MAC is making these days as it aims to get back on the growth track. The other pillar is lip color, led by the $17 lipstick, which is usually marketed in up to 140 shades, followed by the $16 Lipglass and $21 Liptensity, a new, high-pigment coloring that was launched in September. The Studio Fix array of 53 shades has been edited for Ulta. “We are deep into foundation, primer and lipstick.”Īt the heart of MAC’s assortment in Ulta will be the brand’s landmark Studio Fix Fluid and Powder foundation along with Studio Waterweight, Prolongwear Nourishing Waterproof foundation and Next to Nothing, which will be launched in April.

“We worked very closely with Karen and her team to make sure we had the must-haves, the hero products and the pillar categories,” Simon added. Simon said the Ulta curation represents about 45 percent of MAC’s product universe and the individual items were picked in close collaboration between brand and store, playing to MAC’s heritage and Ulta’s penchant for crisp editing. While that number is on a par with Ulta’s big makeup brands - Lancôme, Urban Decay and Clinique - it is a smaller total than the roughly 1,200 sku’s MAC has in departments stores and the 1,500 sku’s in its own brand boutiques. On average, MAC will occupy 200 square feet per store and the product assortment will be limited to 600 stockkeeping units, Buglisi Weiler said. We realize that with the changing behavior you really have be where they want to shop.” Simon concluded, “We are going to introduce new customers to MAC and MAC is going to bring new customers to us.”īuglisi Weiler maintains that MAC is shifting in its philosophy from being “a destination brand” with only “one third of the distribution that most of the makeup brands in specialty have. That just drives traffic for all the brands. We think we are going to get new customers from MAC and new customers through the door. Simon observed, “We know there are people who are curious about MAC and might have wanted to try it, but haven’t done so yet. It’ll help us reach and better serve customer groups and audiences that are important to us, Millennials and ethnically diverse consumers.”

Kimbell agreed, “MAC has consistently been one of the most requested brands by our guests, so we know when we bring it in as the number-one prestige makeup brand - a uniquely positioned strong brand proposition - our guests are going to respond very favorably to it.

Maybe she’s never walked into a Nordstrom to purchase MAC or maybe she’s never walked into a Macy’s.” “In my mind, there’s maybe a customer who shops at Ulta, but has never walked into a MAC store. “This is a great opportunity to bring MAC on stream to a whole new audience,” said Buglisi Weiler. “We continue to have positive traffic - different from a mall - not like a mall,” agreed Tara Simon, senior vice president of prestige merchandising at Ulta. For example, the brand is not sold in Sephora in the U.S., according to executives. distribution mostly to department stores and its international chain of MAC stores, 200 of which are in North America. While MAC is initially going into only a fraction of Ulta stores, the move represents a dramatic departure for the makeup artist brand, which has confined its U.S. “By mid-June we should have the first one opened,” she said. and one that MAC is planning to enter at last, first via the beauty specialty store’s e-commerce platform in May and then via about 25 stores in June.īy the end of the year, MAC is expected to be in more than 100 Ulta stores, according to Karen Buglisi Weiler, MAC global brand president. The answer - as it has been for so many other brands - is Ulta Beauty, one of the hottest retailers in the U.S. MAC Cosmetics is betting that it has found at least a partial solution to the sales slowdown it is suffering as traffic thins out in America’s malls and department stores.

0 kommentar(er)

0 kommentar(er)